Stryker × Inari Medical — Synergy Realization & Valuation

Comprehensive synergy estimation and valuation model for Stryker Corporation’s acquisition of Inari Medical (2025–2028), integrating ROIC, WACC, and Market Value Added (MVA) frameworks.

Objective

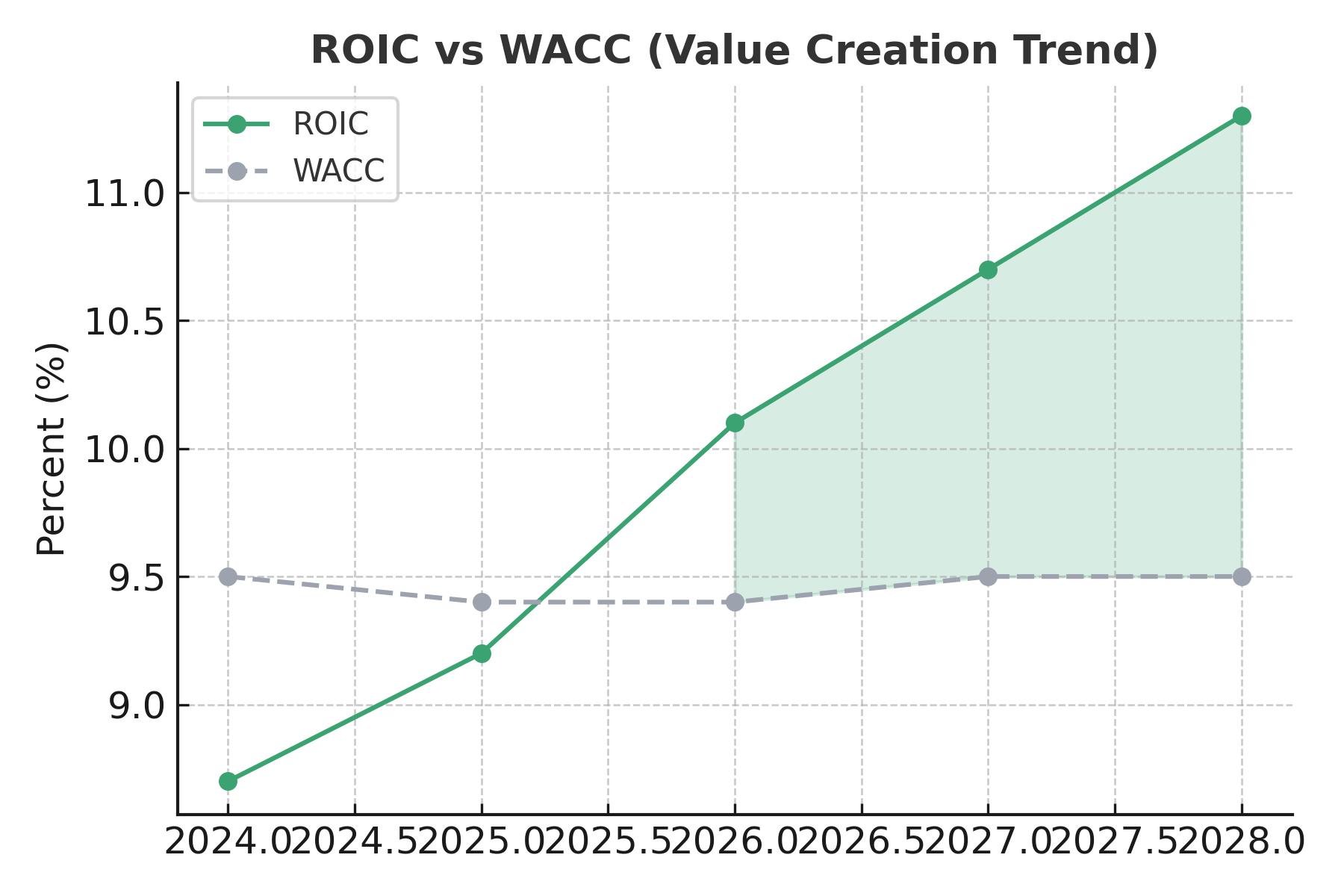

This MBA finance project evaluates the financial and strategic synergies from Stryker Corporation’s acquisition of Inari Medical. It quantifies expected value creation through revenue and cost synergies and measures post-merger performance improvement via ROIC–WACC analysis.

Methodology

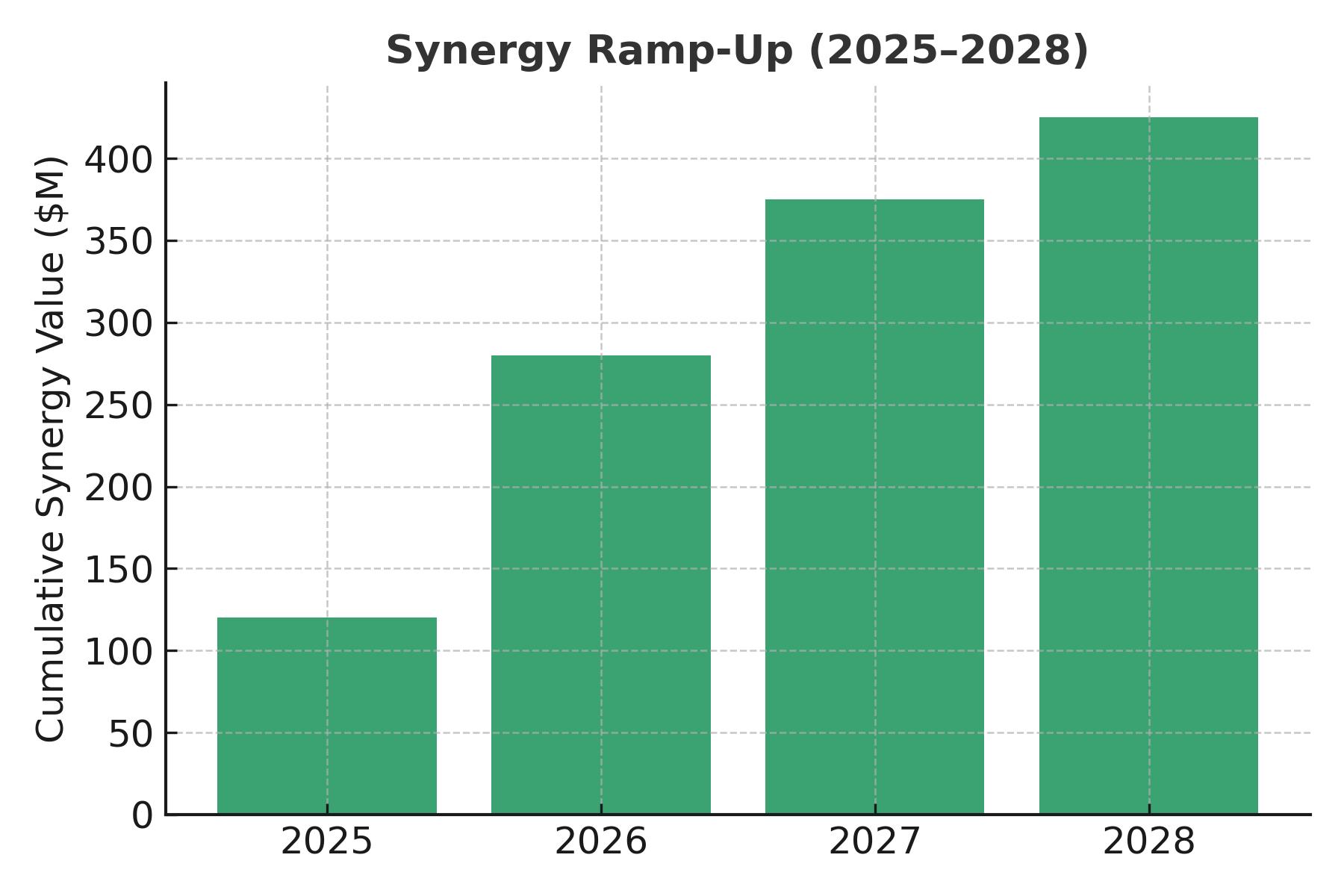

- Developed an integrated Excel-based financial model incorporating dynamic synergy ramp-up rates and cost realization assumptions (2025–2028).

- Built a ROIC bridge comparing pre-merger and post-merger efficiency using NOPAT and Invested Capital frameworks.

- Performed WACC recalibration based on the merged entity’s capital structure, cost of equity, and beta adjustment.

- Executed scenario analysis (Base, Optimistic, Conservative) to stress-test value creation potential.

Key Findings

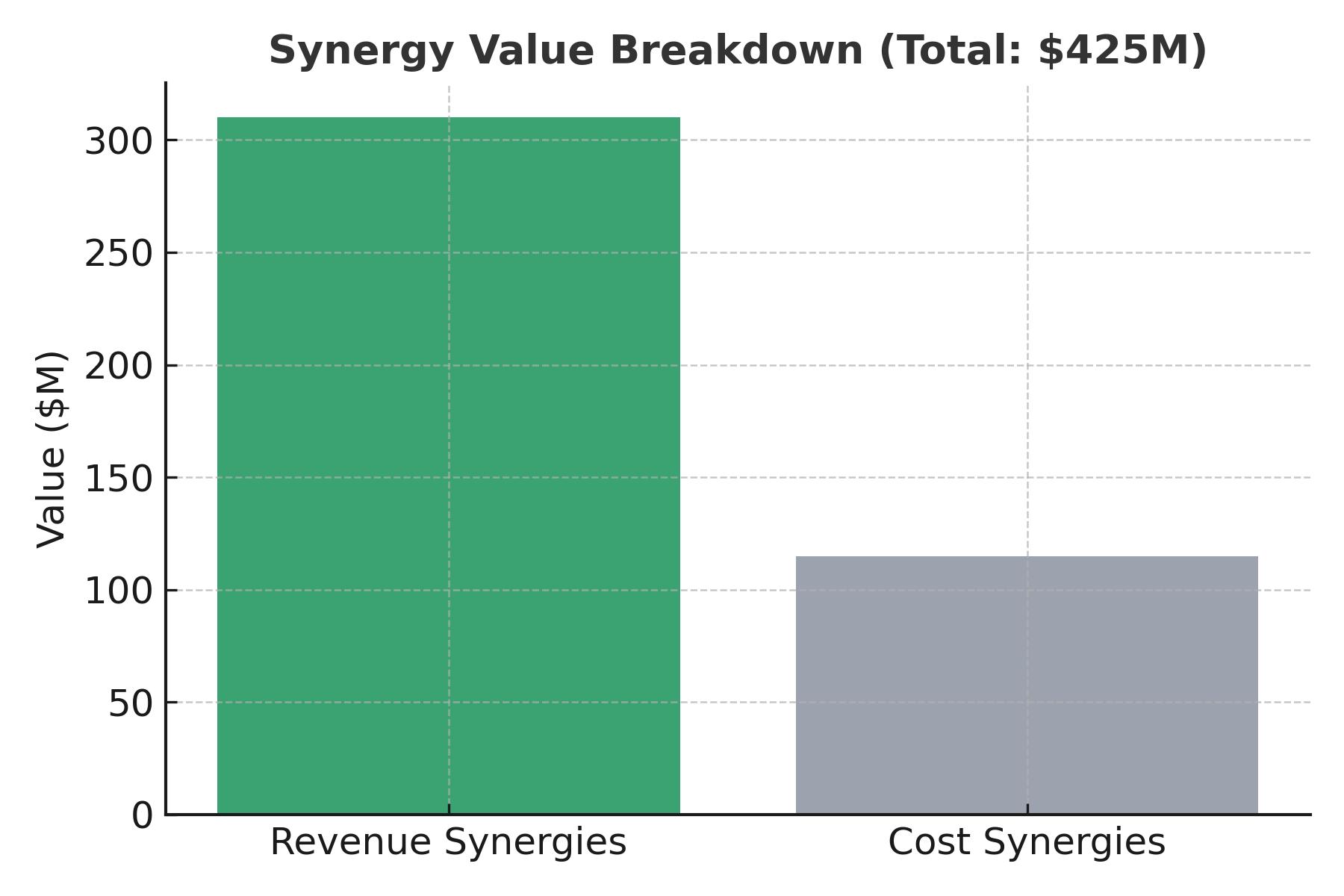

- Total projected synergies: $425 million (Revenue: $310M, Cost: $115M) over 4 years.

- Post-merger ROIC increased from 8.7% to 11.3%, exceeding a WACC of 9.5%.

- SG&A and operational efficiencies contributed 40% of total cost savings.

- Projected EPS accretion from FY2026 onward as synergies mature.

- MVA uplift: $1.2B cumulative shareholder value creation by FY2028.

Strategic Insights

- Commercial synergies: Integration of Inari’s venous disease product line into Stryker’s vascular division for cross-market expansion.

- Operational synergies: Consolidated manufacturing and logistics networks to reduce COGS and lead times.

- SG&A synergies: Combined salesforce and marketing functions yielding 18% headcount efficiency.

- Risk mitigation: Sensitivity tests show the deal remains accretive even at a 15% synergy shortfall.